Daniel B. Klein has written an excellent piece in Intercollegiate Review on the 10 reasons why you shouldn't call leftists "liberal." Klein notes that the word "liberal" has two meanings: (1) that pertaining to generosity and (2) that pertaining to a free man, as in "liberal education." The first to use the term in its political meaning was Adam Smith, and some scholars, such as Larry Siedentop, have claimed that liberalism was the result of Christianity.*

The ideology of the Progressives was not liberal, for it places state institutions at the center of economic decision making, leaving a sphere to a market that is shaped and dominated by the state. This approach was the product of the later German historical school led by Gustav von Schmoller, and Bismarck implemented it.

As it turned out, Schmoller and Bismarck's third way turned into Hitler's third way, which adapted aspects of Mussolini's third way: Fascism. Like Hitler and Mussolini, Franklin D. Roosevelt proposed cartelization and intense state influence on industry. The Supreme Court scuttled Roosevelt's National Industrial Recovery Act, but elements of it, such as the National Labor Relations Act, were enacted.

The interest in third way economic policies flowed from the war economy of World War I. Although World War I was on every level a fiasco, the media convinced the public--modern propaganda having been an important innovation during the war--that without a powerful state the Great War could not have been fought and won.

Alas, without its having been fought and won, the world would have been much better off, but that seems to have escaped my grandfather's and parents' generation, as well as my own.

Also during the World War I era, Herbert Croly and Theodore Roosevelt aimed to paint Progressivism, as

Mussolini did Fascism, as a third way in between liberalism and

socialism. Hence, Progressivism, Fascism, and Nazism are variations of the same system. They differ from the overt socialism of the USSR and Red China, and they also differ from liberalism, which is based on natural rights and profit-seeking and which leads to optimal economic performance. The third way systems and the twentieth century socialist systems evolved from the war economies of World War I, and they are linked to the military state.

Klein is right that the use of the word "liberal" to describe the views of the World War I-derived ideologies--the third way and social democracy--is Orewellian. Whenever the media calls a leftist liberal, a devil gets his horns.

*I was just listening to Professor William R Cook's Great Courses lectures The Catholic Church: A History, and it is evident that mainstream Catholicism has not been in favor of liberalism. In 1864 Pius IX issued Syllabus of Errors, which opposes separation of church and state and claims the right of the Catholic Church to use force. In 1891 the Catholic Church moved to a third way approach under Leo XIII's Rerum Novarum, which opposes class warfare, opposes socialism, favors natural rights (grounded in Thomistic philosophy) and favors private property, but opposes free-market wage determination and favors workplace regulation. Hence, the Bismarckian system, which was, I believe, the product of German Protestants, can also be called Christian. Liberalism is associated with Calvinism, but Lutheranism and Catholicism may be closer to the third way.

Monday, April 29, 2019

Friday, April 26, 2019

Lou Dobbs Cites My "Homogeneous" Paper

Last Monday Lou Dobbs cited my "Homogeneous" paper, published in the journal Academic Questions of the National Association of Scholars. The whole episode is worth watching, but the reference to my paper is at 18:30.

Thursday, April 25, 2019

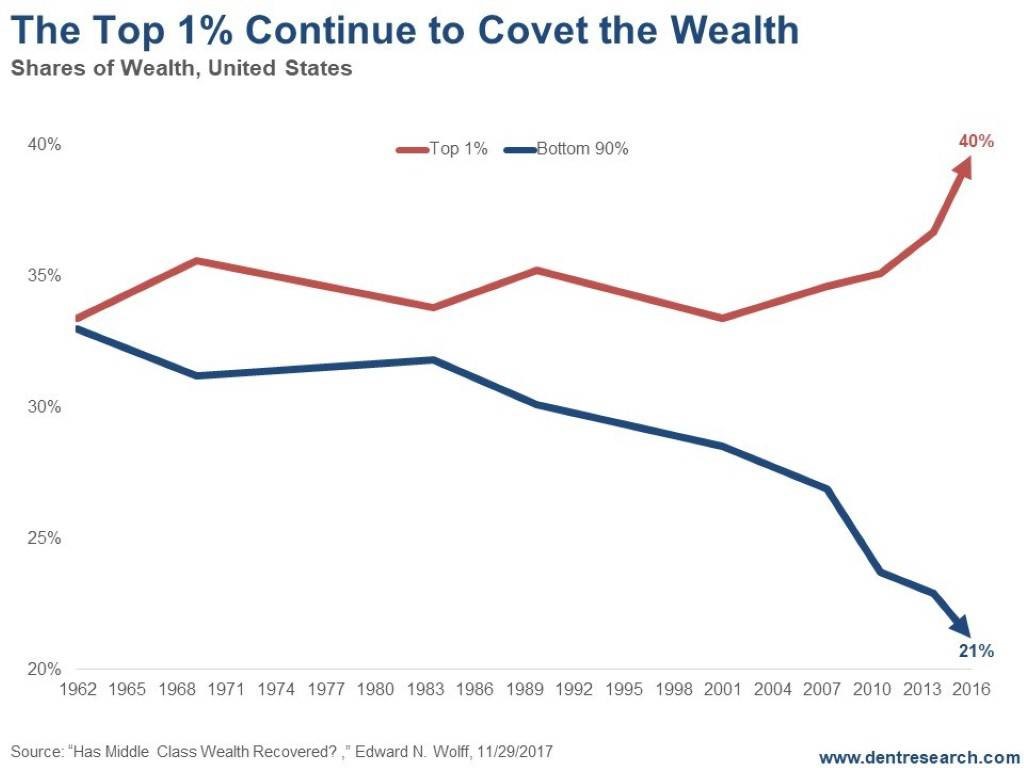

The Greatest Increase in Wealth Inequality in American History Occurred During the Obama Administration

|

| Source: David Stockman Email |

I just received an email from David Stockman's newsletter, and it included the upper graph taken from Edward N. Wolff's "Has Middle Class Wealth Recovered." There are a number of ways to look at the question of rich versus poor; the above graph uses one, the relative shares of the top one percent and the bottom ninety percent. (Disclaimer: I'm one of the nine percent in neither category.)

The gap narrows in the 1970s, but observe the lower graph, which is of real wage growth. Real wages stopped growing in 1973. The reason the wealth inequality declines during the 1970s in the upper graph is that the stock market was falling in the 1970s. Hence, the decline in wealth inequality during the 1970s is a measure of joint pain and only of theoretical importance. The solution put forward by Richard M. Nixon in 1971 was pumping money into the economy via the Federal Reserve Bank.

The gap narrows in the 1970s, but observe the lower graph, which is of real wage growth. Real wages stopped growing in 1973. The reason the wealth inequality declines during the 1970s in the upper graph is that the stock market was falling in the 1970s. Hence, the decline in wealth inequality during the 1970s is a measure of joint pain and only of theoretical importance. The solution put forward by Richard M. Nixon in 1971 was pumping money into the economy via the Federal Reserve Bank.

The pure paper money system established in 1971 helped the wealthy but not the majority. Notice also that the third-most-rapid increase in wealth inequality, according to the upper graph, occurred during the Reagan administration. It began to solidify during the Bush I years, 1988-1992; it remained constant during the Clinton years; then, following the tech bubble bust of 2001 it escalated during the Bush II years, which were the years of the second-greatest gains in wealth inequality. However, Bush and Reagan were pikers compared to Obama, who oversaw the most massive wealth transfers, which followed the 2008 crisis via the expansion of the Federal Reserve's balance sheet, the creation of massive amounts of reserve IOUs called Federal Reserve bank credit, quantitative easing, and so on.

The lower graph tells a slightly different story. Since the early 1970s, when the Fed was given a free hand to redistribute wealth via the creation of paper money, real wages have stagnated. The GDP has continued to grow, although the meaning of GDP is questionable because it includes government spending and make-work projects that do not create value. There is little difference between Democrats and Republicans.

Labels:

bush,

david stockman,

Fed,

income inequality,

money supply,

nixon,

obama,

paper money,

reagan,

wealth inequality

Wednesday, April 24, 2019

King Bear versus Bullzilla

I subscribe to two newsletters with opposite predictions about the markets: David Stockman's Stockman Letter and Steve Sjuggerud's True Wealth, published by Stansberry Research. Stockman is predicting declines in a wide range of markets, including tech and energy, while Sjuggerud is predicting bull markets across the board, but especially in tech and China. There will be a "melt up" (Sjuggerud's term) until a correction, which will occur perhaps 18 months from now.

The great investor Howard Marks, in his book The Most Important Thing, says that being right at the wrong time is the same as being wrong, and from a purely financial perspective he is right. While I'm quoting aphorisms, one that is worth considering is "the trend is your friend."

Sjuggerud doesn't appear to dispute Stockman's underlying theory: The Fed and the current monetary regime are a long-term drain on productivity and economic well being, and the bubble economy it has created is little different from other failed bubble economies of the past, such as John Law's Mississippi Bubble in France in the early 18th century. The ending of a long-term bubble of this kind will not be positive. It may mean long-term stagnation and declining job opportunities, as occurred in Japan, and it may mean a massive crash.

If the trend is our friend, I'm thinking that Sjuggerud's hypothesis is right in the short-run while Stockman's is right in the long-run. Tech and similar investments will do well until they don't. The trick is to gain at least something from the short-term bubbles and to get out while the going is good.

The last tech bubble saw the Nasdaq rise to unprecedented heights. According to Wikipedia: "It reached a price-earnings ratio of 200, dwarfing the peak price-earnings ratio of 80 for the Japanese Nikkei 225 during the Japanese asset price bubble of 1991." It's impossible to know just when a bubble will burst, but it seems to me that the current Nasdaq price-earnings ratio of 18.6 allows leeway for a bubble to proceed. It is true that the prices of today's glamour stocks are at nosebleed levels, but the general market has a ways to go.

The great investor Howard Marks, in his book The Most Important Thing, says that being right at the wrong time is the same as being wrong, and from a purely financial perspective he is right. While I'm quoting aphorisms, one that is worth considering is "the trend is your friend."

Sjuggerud doesn't appear to dispute Stockman's underlying theory: The Fed and the current monetary regime are a long-term drain on productivity and economic well being, and the bubble economy it has created is little different from other failed bubble economies of the past, such as John Law's Mississippi Bubble in France in the early 18th century. The ending of a long-term bubble of this kind will not be positive. It may mean long-term stagnation and declining job opportunities, as occurred in Japan, and it may mean a massive crash.

If the trend is our friend, I'm thinking that Sjuggerud's hypothesis is right in the short-run while Stockman's is right in the long-run. Tech and similar investments will do well until they don't. The trick is to gain at least something from the short-term bubbles and to get out while the going is good.

The last tech bubble saw the Nasdaq rise to unprecedented heights. According to Wikipedia: "It reached a price-earnings ratio of 200, dwarfing the peak price-earnings ratio of 80 for the Japanese Nikkei 225 during the Japanese asset price bubble of 1991." It's impossible to know just when a bubble will burst, but it seems to me that the current Nasdaq price-earnings ratio of 18.6 allows leeway for a bubble to proceed. It is true that the prices of today's glamour stocks are at nosebleed levels, but the general market has a ways to go.

Subscribe to:

Comments (Atom)