I just got a rare piece of good news: Australian IFM is going to buy Buckeye Partners (BPL) for $41.50 a share, and the MLP rose 28% on the news. My stake went up to about $10,000, and I'm thinking about what to do with the money. For the most part, I'm getting old and want yield, so I'm putting a chunk into one of the preferred stock ETFs (PFF or PGX). To maintain my exposure to the depressed MLP sector, I'm also putting some into Kinder Morgan (KMI) and possibly Kayne Anderson (KYN). I'm thinking of putting the little left over into a robotics and artificial intelligence ETF, BOTZ.

Just yesterday a young academic suggested that artificial intelligence and robotics are going to replace much human labor so that the chief jobs for people will involve human interaction and interpersonal skills. He's probably right about the need for interpersonal skills, but the more generalized fear that machines will replace people is wrong. It goes back to the days of the Luddites and before. In 1589 Queen Elizabeth refused to issue a patent to inventor William Lee because of demonstrations against his stocking frame. The reasoning of both crowd and queen was that technology would replace jobs. That was 200 years before the industrial revolution.

Nothing has been better for freedom than technology. Before technology, the only way to become wealthy was to spare the victims of imperialistic wars and turn them into slaves. The Romans considered slaves to be the living dead because the alternative would have been death due to conquest. The South lost the Civil War in part because slave-based societies are less productive, hence poorer, than technology-based societies.

Perhaps because technology ended slavery, one often reads superstitions about technology's ending people in general. It is easy to see the more slave-like jobs that might disappear, but it is difficult to imagine the less slave-like jobs that will replace them.

There was less technology in 1780 than today. At that time the population of the US was three to four million. If you had said to someone that one day there would be motorized tractors that would enable one farmer to do the work of 50 today, you might have added the conclusion that 98% unemployment would ensue and that the workforce would decline. It would have been difficult to imagine the advent of helicopter factories, the profession of accounting, state university professors, and so on.

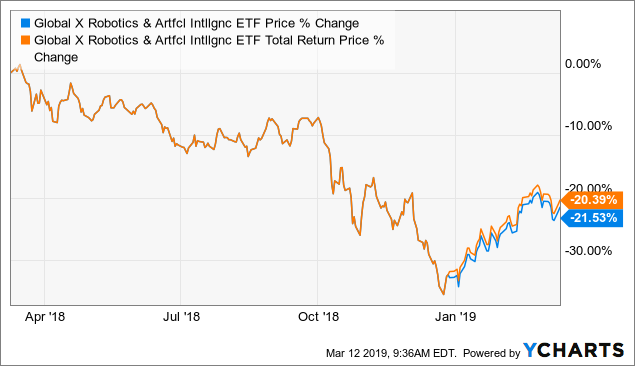

In early January I bought NCR, which has since had a nice run with the broad average and is up 30%. However, BOTZ, the robotics index, hasn't had fantastic returns since its founding two years ago:

| |

| Source: Maks FS,Seeking Alpha |

Apparently, fears about an explosion of robotics overtaking human labor are where the mouth but not the money is.

The reason to be concerned about job replacement is not the technology per se, but its subsidization by central banks and the financial system. When interest rates are artificially depressed, the cost of capital becomes lower, and demand for labor-saving equipment increases. Hence, in the long run low interest rates, the policy of the United States and especially the Democratic Party and its economists like Paul Krugman, have replaced labor with capital. Low interest rates are the chief source of income inequality because they boost stock values, enhancing the income of commercial bankers, investment bankers, real estate investors, stockholders, bond holders, and government employees, and at the same time they reduce wages because of money illusion or inflation and capital substitution.

The Democratic Party further exacerbates the tendency toward income inequality by favoring regulation that squashes human resource development. Minimum wages and mandatory workplace benefits make it more expensive to hire the least skilled, damning them to a lifetime of poverty and dependency. That Democrats consider themselves altruistic in advocating such policies is in the altruistic traditions of Dr. Mengele and Dr. Benway.

Hence, BOTZ, NCR and similar investments are a play on a continued march toward socialism and crony capitalism, not a play on market-driven innovation.