President Trump's escalating trade

war appears to be affecting gold prices, which respond to a stronger dollar. The tariffs will make Chinese goods more

expensive, but the Chinese can make their goods cheaper by making their

currency cheaper to offset the effects of the tariffs. There are many ways the Chinese can do this: The yuan is pegged to the dollar, so they can

lower the peg. This is easy to do

because the Chinese owe at least a trillion dollars in loans to the US, and they hold

trillions in dollars and dollar-denominated loans that they’ve made to the US

government. If they purchase dollars, the dollar will strengthen, and Chinese

goods will become cheaper, offsetting the tariffs.

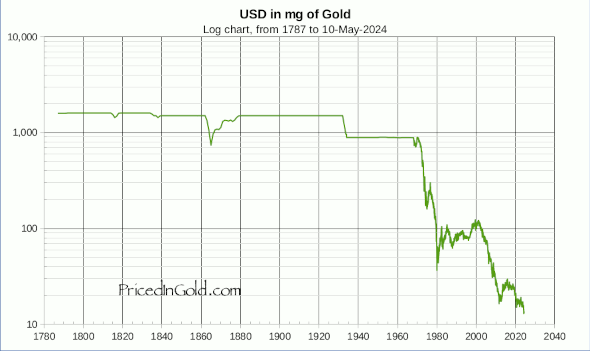

In turn, the price of gold is affected by the dollar. A

stronger dollar means cheaper gold. That correlation has held this week.

In

light of today’s White

House threats of an additional $200 billion in tariffs, the S&P 500 fell almost one percent and gold

fell back to $1244, a fall of about $10.

The yuan

renminbi-to-dollar exchange rate has fallen over the past couple of days to

$0.1497, the lowest level this year.

It

will be seen whether gold can hold a technical $1240 inflection point. If not, there may be a good way down as the Sino-American

trade-and-currency war escalates. That might provide a good entry point for

gold, perhaps below the $1,000 mark.

Hope is not prediction, though.