Monday, June 4, 2018

How Long Will the Dollar Runup Last?

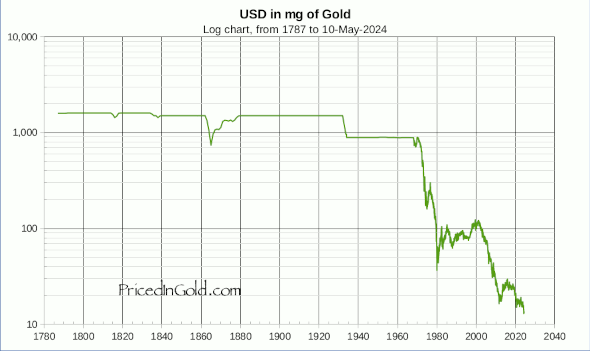

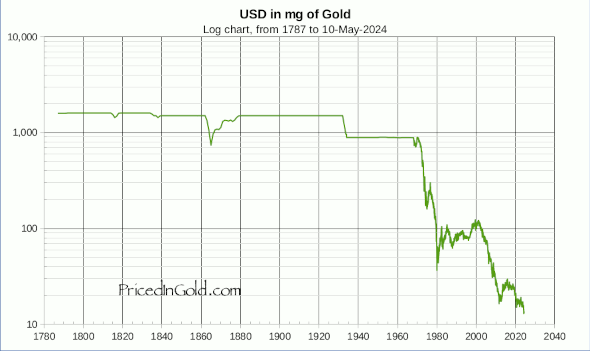

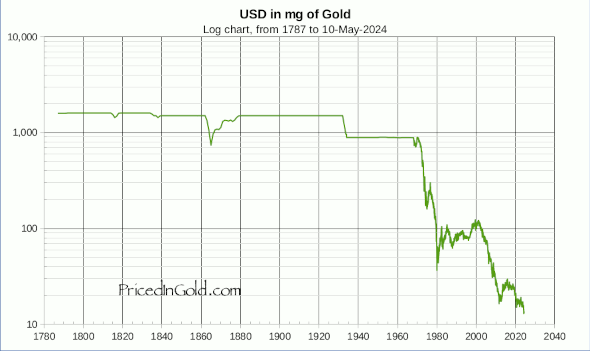

Below is a picture of the log of the dollar valued in milligrams of gold. The sharp decline in the dollar began around 1971, following the Great Society and around the time of the abolition of the gold standard in 1971. The Great Society and mega-government of the LBJ and Nixon eras and the post-Reagan stock market bubble have been funded with paper money. Before then the dollar was relatively stable. The source of the chart is PricedinGold.com . (See the chart here.) The inflection point that worries people holding gold now is the local bottom. My late friend Howard S. Katz wrote about the commodity pendulum whereby Fed monetary expansion reduces the cost of capital, expands the number of miners, pushes down the cost of gold and other commodities, causes bankruptcy among the miners, which in the end results in a whipsaw and additional sharp leg down in the dollar and up in gold. You can see that in the post-1983 Reagan reflation pattern, which ended with the stock market correction of 2000 and an additional sharp decline in the value of the dollar. The question is whether the massive monetary expansion of 2008-2014 will result in an even greater upturn in the value of the dollar than the 1983-2000 upturn. That is, will the current upturn in the dollar's value continue for 17 years or more, as did the 1983-2000 upturn in the value of the dollar. I don't claim to know the answer, but gold miners have sold at depressed levels for some time.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment