Showing posts with label technology. Show all posts

Showing posts with label technology. Show all posts

Wednesday, July 10, 2019

Video Claims That Google Is Functioning as an Arm of the Democratic Party

Google's Orewellian-named ML Fairness system functions as a politically motivated information-massage system. It is consistent with the totalitarian trend among the Democrats, the media, social networking, and higher education. I no longer use Google as my first choice for Web searches, although their technology is still the best. I start with Bing and use Google as a backup. Hopefully, innovators will come up with technology that surpasses Google's, but that has yet to happen. Relying on Google for information about current events is as stupid as relying on the spokesperson for the Democratic Party for information about the Republican Party.

Labels:

google,

politics,

technology,

totalitarianism

Sunday, May 12, 2019

Robots Won't Replace Human Labor Anytime Soon

I just got a rare piece of good news: Australian IFM is going to buy Buckeye Partners (BPL) for $41.50 a share, and the MLP rose 28% on the news. My stake went up to about $10,000, and I'm thinking about what to do with the money. For the most part, I'm getting old and want yield, so I'm putting a chunk into one of the preferred stock ETFs (PFF or PGX). To maintain my exposure to the depressed MLP sector, I'm also putting some into Kinder Morgan (KMI) and possibly Kayne Anderson (KYN). I'm thinking of putting the little left over into a robotics and artificial intelligence ETF, BOTZ.

Just yesterday a young academic suggested that artificial intelligence and robotics are going to replace much human labor so that the chief jobs for people will involve human interaction and interpersonal skills. He's probably right about the need for interpersonal skills, but the more generalized fear that machines will replace people is wrong. It goes back to the days of the Luddites and before. In 1589 Queen Elizabeth refused to issue a patent to inventor William Lee because of demonstrations against his stocking frame. The reasoning of both crowd and queen was that technology would replace jobs. That was 200 years before the industrial revolution.

Nothing has been better for freedom than technology. Before technology, the only way to become wealthy was to spare the victims of imperialistic wars and turn them into slaves. The Romans considered slaves to be the living dead because the alternative would have been death due to conquest. The South lost the Civil War in part because slave-based societies are less productive, hence poorer, than technology-based societies.

Perhaps because technology ended slavery, one often reads superstitions about technology's ending people in general. It is easy to see the more slave-like jobs that might disappear, but it is difficult to imagine the less slave-like jobs that will replace them.

There was less technology in 1780 than today. At that time the population of the US was three to four million. If you had said to someone that one day there would be motorized tractors that would enable one farmer to do the work of 50 today, you might have added the conclusion that 98% unemployment would ensue and that the workforce would decline. It would have been difficult to imagine the advent of helicopter factories, the profession of accounting, state university professors, and so on.

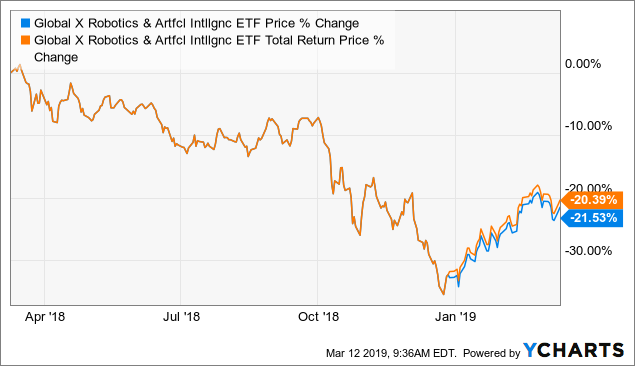

In early January I bought NCR, which has since had a nice run with the broad average and is up 30%. However, BOTZ, the robotics index, hasn't had fantastic returns since its founding two years ago:

| |

| Source: Maks FS,Seeking Alpha |

Apparently, fears about an explosion of robotics overtaking human labor are where the mouth but not the money is.

The reason to be concerned about job replacement is not the technology per se, but its subsidization by central banks and the financial system. When interest rates are artificially depressed, the cost of capital becomes lower, and demand for labor-saving equipment increases. Hence, in the long run low interest rates, the policy of the United States and especially the Democratic Party and its economists like Paul Krugman, have replaced labor with capital. Low interest rates are the chief source of income inequality because they boost stock values, enhancing the income of commercial bankers, investment bankers, real estate investors, stockholders, bond holders, and government employees, and at the same time they reduce wages because of money illusion or inflation and capital substitution.

The Democratic Party further exacerbates the tendency toward income inequality by favoring regulation that squashes human resource development. Minimum wages and mandatory workplace benefits make it more expensive to hire the least skilled, damning them to a lifetime of poverty and dependency. That Democrats consider themselves altruistic in advocating such policies is in the altruistic traditions of Dr. Mengele and Dr. Benway.

Hence, BOTZ, NCR and similar investments are a play on a continued march toward socialism and crony capitalism, not a play on market-driven innovation.

Labels:

botz,

bpl,

buckeye partners,

Democratic Party,

jobs replacement,

kinder morgan,

kyn,

npr,

Paul Krugman,

technology

Saturday, December 30, 2017

It's a Social Security Scheme

Jim Rickards' s Agora Financial forwarded this Vanity Fair article and video-taped interview with Jeffery Gundlach, a Forbes 400 Wall Streeter. According to Wikipedia Gundlach was the fund manager for the TCW total return bond fund. He was fired; then, he founded Doubleline Capital. Wikipedia suggests that he has sometimes been overly bearish. In 2011 he liquidated 55% of his position in municipal bonds, but municipals did not decline.

It is easier to know what will happen than when. Rickards forwarded the piece because Gundlach is bearish on bonds--six years after his pullout from munis. That is understandable. I too have been bearish, cutting back on my stock holdings in 2016 and hence getting a smaller benefit from the 2017 rally than I might have. (As well, I am a tech skeptic, which also has been a costly mistake. C'est la vie.)

The current rally will snap, either in '18 or later, and there will be a correction. There will then be monetary expansion on top of the already immense monetary expansion since 2008, and Americans will continue to suffer declines in their real wages and real household income as Wall Streeters like Gundlach benefit handsomely and those with at least some assets in the market continue to gain.

What I found most interesting about Gundlach's talk is his cavalier attitude toward screwing middle income baby boomers by instituting means testing for Social Security. He does not seem to have thought through the issue carefully, but he seems to suggest that currently benefit-eligible elderly should have their benefits cut in order to make federal government bonds more attractive to him.

Like all Wall Streeters, Gundlach has benefited handsomely from public subsidization. No one knows how wealthy Warren Buffett or Jeff Gundlach would have been without the massive monetary expansion since 1971, but neither would be nearly as wealthy as they are. Feeling comfortable with his own benefits from the public purse, Gundlach sees the need to cure federal indebtedness fast by reducing Social Security benefits. That way bonds will surely rally.

Gundlach is right that benefits need to be reduced. Federal indebtedness is now in excess of 100% of GDP, not including the future unfunded liabilities of the Social Security System. According to CNBC, if actuaries use an unlimited time horizon (beyond 75 years) rather than a 75-year horizon, the future unfunded liabilities of the system are $32 trillion. Current GDP is $19 trillion.

Projections beyond 10 or 20 years have little meaning because the assumptions that actuaries make become increasingly inaccurate. Technological shifts, demographic shifts, wars, diseases, impoverishment of the middle class, inflation, and monetary expansion change life expectancy. CNBC claims that until 2034 Social Security will be able to cover benefits. Thereafter, there will be a 25% deficit until 2090. After that the system will be in extremis.

Gundlach suggests that boomers' benefits be cut by instituting means testing. In other words, the middle income savers whom Gundlach's backers at the Fed have screwed by reducing interest rates should be screwed again by means testing Social Security. Those who made life decisions based on government lies that Social Security is an insurance plan should end their lives in poverty. Gundlach is confident that boomers will not complain. He claims that they are a unique generation, but he does not offer a reason.

Gundlach is right: Through monetary policy Wall Street has screwed boomers who save, and they have been too dumb to complain for 40 years, so Wall Street's lackeys in Congress might as well once again screw them by cutting Social Security in order to gain a few extra years' bond rally. They likely won't complain again. Gundlach will profit. That's what the phrase "a good economy" means in today's English language.

As Gundlach suggests, the retirement age should be raised. An increase of one year beginning with two years from now might be a fair solution. Thus, people born in 1953 wouldn't get full benefits until 2020; people born in 1954 (my birth year) wouldn't get full benefits until 2022, and so on. The full-benefit age might be raised to 72. That would likely solve the short-term problem. Actuaries will need to determine the precise increase in retirement age. Fairer still would be slower increases of say six months or to start the increases five years hence so that those nearing retirement will have time to plan.

In some areas Gundlach is surprisingly uninformed. He suggests, for instance, that air conditioning repair men, competent, technically trained blue collar workers, are now permanently unemployed. That claim reflects economic illiteracy. I have seen this strange claim repeatedly coming from elite America. It reflects the lack of competent economic instruction at elite, left-wing universities.

In any case, the employment rate in America is currently at an all-time high. Many technical jobs remain unfilled. The employment-to-population ratio is slightly lower than in 2008, but that is to be expected given an aging population. The employment-to-population ratio in Nov. 2017 was 60.1; it was 63.3 in January 2007. The number of employed is at an all-time high.

The high employment rate has been achieved by reducing real wages through monetary expansion. More Americans work; they earn lower wages. The wealth is transferred to Wall Street because the low interest rates boost the bond market. Insiders like Gundlach and Buffett benefit most as Americans work harder for suppressed wages.

Social Security was originally sold to Americans as an insurance plan combined with a welfare plan. There is no such thing. Insurance is actuarially fair. If there is no actuarial relationship between contributions and benefits, then the plan is not insurance. Social Security was designed to give higher benefits to lower earners than they have earned and lower benefits to higher earners than they have earned. There was never any connection between the FICA tax and the OASDI Social Security benefit.

The plan was set up to fool people. It was set up to be a fraud. The biggest fraud was the impression given to Americans that there is a fund into which their contributions go to fund their own retirement. That deception was accomplished by pretending that FICA was somehow separate from other federal taxes and somehow linked to OASDI. It has always been just another, albeit regressive, income tax with no connection to the statutory welfare benefit that OASDI provides.

There is no easy way out of the mess that the two parties have caused with respect to Social Security. There are ways to reformulate monetary policy. The two parties will not betray Wall Street, and I'm afraid Americans are unable to think without the say-so of Wall Street-backed media. Perhaps in the future the phrase "Social Security scheme" can replace the phrase "Ponzi scheme."

It is easier to know what will happen than when. Rickards forwarded the piece because Gundlach is bearish on bonds--six years after his pullout from munis. That is understandable. I too have been bearish, cutting back on my stock holdings in 2016 and hence getting a smaller benefit from the 2017 rally than I might have. (As well, I am a tech skeptic, which also has been a costly mistake. C'est la vie.)

The current rally will snap, either in '18 or later, and there will be a correction. There will then be monetary expansion on top of the already immense monetary expansion since 2008, and Americans will continue to suffer declines in their real wages and real household income as Wall Streeters like Gundlach benefit handsomely and those with at least some assets in the market continue to gain.

What I found most interesting about Gundlach's talk is his cavalier attitude toward screwing middle income baby boomers by instituting means testing for Social Security. He does not seem to have thought through the issue carefully, but he seems to suggest that currently benefit-eligible elderly should have their benefits cut in order to make federal government bonds more attractive to him.

Like all Wall Streeters, Gundlach has benefited handsomely from public subsidization. No one knows how wealthy Warren Buffett or Jeff Gundlach would have been without the massive monetary expansion since 1971, but neither would be nearly as wealthy as they are. Feeling comfortable with his own benefits from the public purse, Gundlach sees the need to cure federal indebtedness fast by reducing Social Security benefits. That way bonds will surely rally.

Gundlach is right that benefits need to be reduced. Federal indebtedness is now in excess of 100% of GDP, not including the future unfunded liabilities of the Social Security System. According to CNBC, if actuaries use an unlimited time horizon (beyond 75 years) rather than a 75-year horizon, the future unfunded liabilities of the system are $32 trillion. Current GDP is $19 trillion.

Projections beyond 10 or 20 years have little meaning because the assumptions that actuaries make become increasingly inaccurate. Technological shifts, demographic shifts, wars, diseases, impoverishment of the middle class, inflation, and monetary expansion change life expectancy. CNBC claims that until 2034 Social Security will be able to cover benefits. Thereafter, there will be a 25% deficit until 2090. After that the system will be in extremis.

Gundlach suggests that boomers' benefits be cut by instituting means testing. In other words, the middle income savers whom Gundlach's backers at the Fed have screwed by reducing interest rates should be screwed again by means testing Social Security. Those who made life decisions based on government lies that Social Security is an insurance plan should end their lives in poverty. Gundlach is confident that boomers will not complain. He claims that they are a unique generation, but he does not offer a reason.

Gundlach is right: Through monetary policy Wall Street has screwed boomers who save, and they have been too dumb to complain for 40 years, so Wall Street's lackeys in Congress might as well once again screw them by cutting Social Security in order to gain a few extra years' bond rally. They likely won't complain again. Gundlach will profit. That's what the phrase "a good economy" means in today's English language.

As Gundlach suggests, the retirement age should be raised. An increase of one year beginning with two years from now might be a fair solution. Thus, people born in 1953 wouldn't get full benefits until 2020; people born in 1954 (my birth year) wouldn't get full benefits until 2022, and so on. The full-benefit age might be raised to 72. That would likely solve the short-term problem. Actuaries will need to determine the precise increase in retirement age. Fairer still would be slower increases of say six months or to start the increases five years hence so that those nearing retirement will have time to plan.

In some areas Gundlach is surprisingly uninformed. He suggests, for instance, that air conditioning repair men, competent, technically trained blue collar workers, are now permanently unemployed. That claim reflects economic illiteracy. I have seen this strange claim repeatedly coming from elite America. It reflects the lack of competent economic instruction at elite, left-wing universities.

In any case, the employment rate in America is currently at an all-time high. Many technical jobs remain unfilled. The employment-to-population ratio is slightly lower than in 2008, but that is to be expected given an aging population. The employment-to-population ratio in Nov. 2017 was 60.1; it was 63.3 in January 2007. The number of employed is at an all-time high.

The high employment rate has been achieved by reducing real wages through monetary expansion. More Americans work; they earn lower wages. The wealth is transferred to Wall Street because the low interest rates boost the bond market. Insiders like Gundlach and Buffett benefit most as Americans work harder for suppressed wages.

Social Security was originally sold to Americans as an insurance plan combined with a welfare plan. There is no such thing. Insurance is actuarially fair. If there is no actuarial relationship between contributions and benefits, then the plan is not insurance. Social Security was designed to give higher benefits to lower earners than they have earned and lower benefits to higher earners than they have earned. There was never any connection between the FICA tax and the OASDI Social Security benefit.

The plan was set up to fool people. It was set up to be a fraud. The biggest fraud was the impression given to Americans that there is a fund into which their contributions go to fund their own retirement. That deception was accomplished by pretending that FICA was somehow separate from other federal taxes and somehow linked to OASDI. It has always been just another, albeit regressive, income tax with no connection to the statutory welfare benefit that OASDI provides.

There is no easy way out of the mess that the two parties have caused with respect to Social Security. There are ways to reformulate monetary policy. The two parties will not betray Wall Street, and I'm afraid Americans are unable to think without the say-so of Wall Street-backed media. Perhaps in the future the phrase "Social Security scheme" can replace the phrase "Ponzi scheme."

Friday, March 30, 2012

The Federal Reserve Goes Parabolic

When traders say that a security has gone parabolic, they mean its price is increasing at an increasing rate. Naive investors are drawn to the security, but to experienced investors the rapid increases signal an incipient collapse. That's because the excessive price stimulates experienced investors to sell. The upward spiral ends, causing those who entered the market during the parabolic increase to sell too. The ensuing crash is excessive, and the price falls below the security's true value because investors who otherwise would have held the security sell from fear.

The Federal Reserve Bank has increased the money supply at a parabolic rate. The money supply has been increasing regularly since the 1930s. Once of the results of the money supply's increase has been excessive investment in real estate, especially in politically sanctioned projects. The projects include the urban renewal of the 1950s and 1960s, the construction of the suburbs, the development of the suburban mall, the expansion of retailing, and the sub-prime crisis. Some of these would have occurred, but to a lesser extent, without the Fed. Others, like the sub-prime crisis, would not have occurred at all.

The excessive real estate investment arose because the money the Fed creates is deposited with risk- averse money center banks that prefer guaranteed returns. Besides the real estate bubble of the past seven decades, there has been a government bubble. Rather than rely on democracy, which would not have supported the current level of spending if taxpayers had been forced to pay the market value of the cost of government each year, the central bank facilitates issuance of bonds, allowing the public to vote for politicians who spend more than the public has in resources. The public lacks the intellect to vote otherwise--its taste for doing what seems right or beneficial prevails because it lacks the ability to analyze the costs. The advent of Keynesian economics causes supposed experts to offer the irrational advice that the public favors on its own--to spend money it does not have.

Hence, the Federal Reserve is inconsistent with democracy because it permits the public to vote for politicians who spend more than the public would want them to if they were required to cover the costs, and to spend more than government can pay back. The resulting debt is becoming too large to pay back. Government will then deprive bond holders of their wealth by debasing the currency.This will harm those whose assets are in dollars or who receive wages.

The public does not want a dollar collapse--but it votes for it because the media and the government-financed school system advertise a distorted view of the costs and cripple citizens intellectually so that they believe the claims of supposed experts even when they are repeatedly wrong. A case in point is the economics profession. Few economists predicted the sub-prime crisis or the tech bubble. But, despite their history of error, economists and the news media continue to broadcast the same predictions.

The money center banks tend to invest with risk-averse, large corporations. It is evident that the corporations are risk averse because executives need to be paid in stock options whose purpose is to stimulate risk. Wall Street sanctions publicly traded corporations through the stock market. Executives are rewarded if the stock price rises. The corporations, then, only take risks of which Wall Street approves. The result of hiring psychologically deviant, risk-averse executives and then countering the risk aversion with stock options is that the nature of the risk the executives take tends to pander to Wall Street's needs. As a result, mergers and acquisitions tend to dominate firms' risk taking. Firms do not serve product markets--they serve financial markets.

The largest way that the Fed distorts risk taking is through its subsidies to the stock-and-bond markets, and, consequently, hedge funds through (1) direct lending to hedge funds and Wall Street banks, (2) issuance of government securities that Wall Street sells, and (3) depression of interest rates that cause the stock market to increase inversely. The rise in the stock market since 1937 is due to the Federal Reserve Bank. That rise has come out of the real hourly wage.

In 2008 the Fed began a massive quantitative easing that has caused bank credit to increase three fold and may potentially increase the money supply thirty fold. This is equivalent to a parabolic price increase in the securities market. The effects of the parabolic increase are (1) trivialization of technology at an increasing rate, (2) increasing crony capitalism, and investment in frivolous public-private partnerships, (3) subsidies to hedge funds and other socially unproductive financial firms, and (4) the current stock and real estate market comebacks.

The trivialization of technology is seen in the massive stock price increases of firms like Facebook and LinkedIn. In the 19th century, technology meant the invention of the automobile and A/C electricity. In the 21st century it means a program by which you add people unknown to you, called friends, to a computer program whose purpose is also unknown.

Like all parabolic price increases, this one too shall pass. But the collapse of the dollar's value does not just mean that a few greedy investors will be harmed. It means that all working Americans, suckers who have voted for Democrats and Republicans, will be harmed.

The Federal Reserve Bank has increased the money supply at a parabolic rate. The money supply has been increasing regularly since the 1930s. Once of the results of the money supply's increase has been excessive investment in real estate, especially in politically sanctioned projects. The projects include the urban renewal of the 1950s and 1960s, the construction of the suburbs, the development of the suburban mall, the expansion of retailing, and the sub-prime crisis. Some of these would have occurred, but to a lesser extent, without the Fed. Others, like the sub-prime crisis, would not have occurred at all.

The excessive real estate investment arose because the money the Fed creates is deposited with risk- averse money center banks that prefer guaranteed returns. Besides the real estate bubble of the past seven decades, there has been a government bubble. Rather than rely on democracy, which would not have supported the current level of spending if taxpayers had been forced to pay the market value of the cost of government each year, the central bank facilitates issuance of bonds, allowing the public to vote for politicians who spend more than the public has in resources. The public lacks the intellect to vote otherwise--its taste for doing what seems right or beneficial prevails because it lacks the ability to analyze the costs. The advent of Keynesian economics causes supposed experts to offer the irrational advice that the public favors on its own--to spend money it does not have.

Hence, the Federal Reserve is inconsistent with democracy because it permits the public to vote for politicians who spend more than the public would want them to if they were required to cover the costs, and to spend more than government can pay back. The resulting debt is becoming too large to pay back. Government will then deprive bond holders of their wealth by debasing the currency.This will harm those whose assets are in dollars or who receive wages.

The public does not want a dollar collapse--but it votes for it because the media and the government-financed school system advertise a distorted view of the costs and cripple citizens intellectually so that they believe the claims of supposed experts even when they are repeatedly wrong. A case in point is the economics profession. Few economists predicted the sub-prime crisis or the tech bubble. But, despite their history of error, economists and the news media continue to broadcast the same predictions.

The money center banks tend to invest with risk-averse, large corporations. It is evident that the corporations are risk averse because executives need to be paid in stock options whose purpose is to stimulate risk. Wall Street sanctions publicly traded corporations through the stock market. Executives are rewarded if the stock price rises. The corporations, then, only take risks of which Wall Street approves. The result of hiring psychologically deviant, risk-averse executives and then countering the risk aversion with stock options is that the nature of the risk the executives take tends to pander to Wall Street's needs. As a result, mergers and acquisitions tend to dominate firms' risk taking. Firms do not serve product markets--they serve financial markets.

The largest way that the Fed distorts risk taking is through its subsidies to the stock-and-bond markets, and, consequently, hedge funds through (1) direct lending to hedge funds and Wall Street banks, (2) issuance of government securities that Wall Street sells, and (3) depression of interest rates that cause the stock market to increase inversely. The rise in the stock market since 1937 is due to the Federal Reserve Bank. That rise has come out of the real hourly wage.

In 2008 the Fed began a massive quantitative easing that has caused bank credit to increase three fold and may potentially increase the money supply thirty fold. This is equivalent to a parabolic price increase in the securities market. The effects of the parabolic increase are (1) trivialization of technology at an increasing rate, (2) increasing crony capitalism, and investment in frivolous public-private partnerships, (3) subsidies to hedge funds and other socially unproductive financial firms, and (4) the current stock and real estate market comebacks.

The trivialization of technology is seen in the massive stock price increases of firms like Facebook and LinkedIn. In the 19th century, technology meant the invention of the automobile and A/C electricity. In the 21st century it means a program by which you add people unknown to you, called friends, to a computer program whose purpose is also unknown.

Like all parabolic price increases, this one too shall pass. But the collapse of the dollar's value does not just mean that a few greedy investors will be harmed. It means that all working Americans, suckers who have voted for Democrats and Republicans, will be harmed.

Friday, July 18, 2008

Conformity, Rigidity and Decline

Max von Weber developed the thesis that America's Protestant roots led to a focus on capitalism because several Protestant sects view success in the world as evidence of divine grace. Reinhard Bendix developed Weber's spirit of capitalism thesis further in his Work and Authority in Industry in which he saw a historical pattern in the American interpretation of divine election's being carried forward in an ideological justification of managerial power despite the nation's democratic value system. Managers and big businessmen are entitled to social approval and legitimacy because of an evolving ideological justification. Bendix argued that the religious justification became a moral one, then shifted into social Darwinism and a biological justification. The ideological justification of managerial power then focused on psychological variables such as positive thinking. Frederick W. Taylor's scientific management was but one additional step on the road of ideological justification of business power. Taylor's scientific management, which holds that an industrial engineer is necessary to design work and control workers in turn evolved into the human relations school which argued that managers could understand workers' emotions and so constitute an elite, continuing the religious interpretation of divine election as applicable to management.

However, as Bendix emphasizes in his comparative study, managerial authority is justified in alternative ways around the world. The existence of managerial power is in part the result of economic and business necessity, for business cannot be managed democratically. Organizations can be managed democratically if there is little need for coordination. As coordination needs incrase, the possibility of democratic governance diminishes. Thus, capitalism, which depends on free market coordination and so does not require direction is most consistent with democracy, while socialism, in which government officers must direct the economy as well as the civil and military state functions tht exist under capitalism, tends toward dictatorship and suppression of diversity. Universities require little coordination because the work of scholarship is individual or collaborative on a small-group basis, hence universities can be run relatively democratically, but collaboration and coordination on a large scale is required of large manufacturing firms, so they must be run on an authoritarian basis. Thus, one of the most important writers on the subject of unity of command was not an American Protestant but a French Catholic, Henri Fayol. Fayol, a mining executive, emphasized authority, discipline, unity of command and unity of direction in his book General and Industrial Management, published in 1917. But Fayol's principles of management focus on large-scale industrial enterprise, and so may be less important to small firms, firms where coordination is not necessary (such as in universities, think tanks, firms with heavy emphasis on individual salesmanship or consulting firms). Thus, as Thompson has pointed out, technology is likely to influence the method of control. Thompson argued that there are three basic kinds of technologies, pooled, sequential and reciprocal. In sequential technologies tasks are performed in a required order and planning is critical. An example would be an assembly line. In pooled task interdependence the workers work separately but are guided by a central office. Coordination demands are minimal. Examples would be many service industries, sales offices where the salesmen work separately and universities. In reciprocal interdependence work may be broken into units that must interact flexibly. Thompson argued that sequential processes require the most control and should be grouped by process. In contrast, work requiring pooled processes need to be coordinated at a high level and coordination may not be possible. Reciprocal technologies such as involving teamwork need to be coordinated at a low level. If there are multiple reciprocal technologies then complexity necessitates decentralization.

Thus, the nature of authority relations may be imbued with a religious sense but may also shift with changing technology. The demands of government and the economy may shift in response to changing technology. As innovation changes the pace and rate of interaction, the nature of authority relations, public intervention in the market place, political control and the flexibility of government agencies might need to change along with it. Regulatory systems that mandate standard practices may be inappropriate in an economy where the flexibility of pooled or small group reciprocal relations requires rapid change. Yet because of the religious quality of authority structures, political factions may insist on ritualized patterns that seem important to them.

Americans in part believe in a natural aristocracy, one that is created by markets. But the religious aspect of Americans' value system may permit the emphasis on markets to be replaced by tradition. Because a businessman was successful in the past, there is a tendency to believe that he is entitled to success in the present and future as well, even if his decisions fail to correspond to reality. Thus, public conformity tends to support regulatory and financial systems even when the technology to which they respond have changed, have moved from sequential to pooled and reciprocal. The United States is no longer a manufacturing country, but its financial and regulatory regimes assume the importance of large firms, rigid production requirements and the need for government-supplied financing.

In Louis Hartz's Liberal Tradition in America Hartz argues that because America lacks a feudal tradition, it has never been drawn to socialism. Rather, he argues that Progressivism and New Deal social democracy are variants of Lockian liberalism. American society was based on Locke and was free prior to the American revolution, so Americans did not overthrow a feudal past. Rather, the American revolution reinforced values that were already present (p. 10):

"Here is a Lockean doctrine which in the West as a whole is the symbol of rationalism, yet in America the devotion to it has been so irrational that it has not even been recognized for what it is: liberalism. There has never been a liberal movement or a real liberal party in America: we have only had the American Way of Life, a nationalist articulation of Locke which usually does not know that Locke himself is involved...Ironically, 'liberalism' is a stranger in the land of its greatest realization and fulfillment. But this is not all. Here is a doctrine which everywhere in the West has been a glorious symbol of individual liberty, yet in America its compulsive power has been so great that it has posed a threat to liberty itself. Actually, Locke has a hidden conformitarian germ to begin with, since natural law tells equal people equal things, but when this germ is fed by the explosive power of modern nationalism, it mushrooms into something pretty remarkable. One can reasonably wonder about the liberty one finds in Burke.

"I believe that this is the basic ethical problem of a liberal society: not the danger of the majority which has been its conscious fear, but the danger of unanimity, which has slumbered unconsciously behind it: the 'tyranny of opinion' that Tocqueville saw unfolding as even the pathetic social distinctions of the Federalist era collapsed before his eyes...The decisive domestic issue of our time may well be the counter resources a liberal society can muster against this deep and unwritten tyrannical compulsion it contains. Given the individualist nature of the Lockean doctrine, there is always a logical impulse within it to transcend the very conformitarian spirit it breeds in a Lockean society..."Amricanism" oddly disadvantages the Progressive despite the fact that he shares it to the full, there is a strategic impulse within him to transcend it...In some sense the tragedy of these movements has lain in the imperfect knowledge that they have had of the enemy they face, above all in their failure to see their own unwitting contribution to his strength."

American conformitarianism has accepted a regulatory reform and institution of elites that is impractical because technology and the pace of market change has rendered them obsolete. As Americans sense a deterioration, not only in the average hourly real wage but also in the volatility of the housing and stock markets, they sense that there is something amiss; that systems have not responded to their expectations. But the systems have become institutionalized to a degree that has never existed in America before. Previously, because Americans lived in a laissez faire world, only the courts, the local governments and a few federal systems such as the post office were institutionalized rigidly. Now, much of American life, not only in the public sector in areas like Social Security have become rigidly institutionalized and unable to change, but also in the private sector. Firms are no longer permitted to fail.

However, as Bendix emphasizes in his comparative study, managerial authority is justified in alternative ways around the world. The existence of managerial power is in part the result of economic and business necessity, for business cannot be managed democratically. Organizations can be managed democratically if there is little need for coordination. As coordination needs incrase, the possibility of democratic governance diminishes. Thus, capitalism, which depends on free market coordination and so does not require direction is most consistent with democracy, while socialism, in which government officers must direct the economy as well as the civil and military state functions tht exist under capitalism, tends toward dictatorship and suppression of diversity. Universities require little coordination because the work of scholarship is individual or collaborative on a small-group basis, hence universities can be run relatively democratically, but collaboration and coordination on a large scale is required of large manufacturing firms, so they must be run on an authoritarian basis. Thus, one of the most important writers on the subject of unity of command was not an American Protestant but a French Catholic, Henri Fayol. Fayol, a mining executive, emphasized authority, discipline, unity of command and unity of direction in his book General and Industrial Management, published in 1917. But Fayol's principles of management focus on large-scale industrial enterprise, and so may be less important to small firms, firms where coordination is not necessary (such as in universities, think tanks, firms with heavy emphasis on individual salesmanship or consulting firms). Thus, as Thompson has pointed out, technology is likely to influence the method of control. Thompson argued that there are three basic kinds of technologies, pooled, sequential and reciprocal. In sequential technologies tasks are performed in a required order and planning is critical. An example would be an assembly line. In pooled task interdependence the workers work separately but are guided by a central office. Coordination demands are minimal. Examples would be many service industries, sales offices where the salesmen work separately and universities. In reciprocal interdependence work may be broken into units that must interact flexibly. Thompson argued that sequential processes require the most control and should be grouped by process. In contrast, work requiring pooled processes need to be coordinated at a high level and coordination may not be possible. Reciprocal technologies such as involving teamwork need to be coordinated at a low level. If there are multiple reciprocal technologies then complexity necessitates decentralization.

Thus, the nature of authority relations may be imbued with a religious sense but may also shift with changing technology. The demands of government and the economy may shift in response to changing technology. As innovation changes the pace and rate of interaction, the nature of authority relations, public intervention in the market place, political control and the flexibility of government agencies might need to change along with it. Regulatory systems that mandate standard practices may be inappropriate in an economy where the flexibility of pooled or small group reciprocal relations requires rapid change. Yet because of the religious quality of authority structures, political factions may insist on ritualized patterns that seem important to them.

Americans in part believe in a natural aristocracy, one that is created by markets. But the religious aspect of Americans' value system may permit the emphasis on markets to be replaced by tradition. Because a businessman was successful in the past, there is a tendency to believe that he is entitled to success in the present and future as well, even if his decisions fail to correspond to reality. Thus, public conformity tends to support regulatory and financial systems even when the technology to which they respond have changed, have moved from sequential to pooled and reciprocal. The United States is no longer a manufacturing country, but its financial and regulatory regimes assume the importance of large firms, rigid production requirements and the need for government-supplied financing.

In Louis Hartz's Liberal Tradition in America Hartz argues that because America lacks a feudal tradition, it has never been drawn to socialism. Rather, he argues that Progressivism and New Deal social democracy are variants of Lockian liberalism. American society was based on Locke and was free prior to the American revolution, so Americans did not overthrow a feudal past. Rather, the American revolution reinforced values that were already present (p. 10):

"Here is a Lockean doctrine which in the West as a whole is the symbol of rationalism, yet in America the devotion to it has been so irrational that it has not even been recognized for what it is: liberalism. There has never been a liberal movement or a real liberal party in America: we have only had the American Way of Life, a nationalist articulation of Locke which usually does not know that Locke himself is involved...Ironically, 'liberalism' is a stranger in the land of its greatest realization and fulfillment. But this is not all. Here is a doctrine which everywhere in the West has been a glorious symbol of individual liberty, yet in America its compulsive power has been so great that it has posed a threat to liberty itself. Actually, Locke has a hidden conformitarian germ to begin with, since natural law tells equal people equal things, but when this germ is fed by the explosive power of modern nationalism, it mushrooms into something pretty remarkable. One can reasonably wonder about the liberty one finds in Burke.

"I believe that this is the basic ethical problem of a liberal society: not the danger of the majority which has been its conscious fear, but the danger of unanimity, which has slumbered unconsciously behind it: the 'tyranny of opinion' that Tocqueville saw unfolding as even the pathetic social distinctions of the Federalist era collapsed before his eyes...The decisive domestic issue of our time may well be the counter resources a liberal society can muster against this deep and unwritten tyrannical compulsion it contains. Given the individualist nature of the Lockean doctrine, there is always a logical impulse within it to transcend the very conformitarian spirit it breeds in a Lockean society..."Amricanism" oddly disadvantages the Progressive despite the fact that he shares it to the full, there is a strategic impulse within him to transcend it...In some sense the tragedy of these movements has lain in the imperfect knowledge that they have had of the enemy they face, above all in their failure to see their own unwitting contribution to his strength."

American conformitarianism has accepted a regulatory reform and institution of elites that is impractical because technology and the pace of market change has rendered them obsolete. As Americans sense a deterioration, not only in the average hourly real wage but also in the volatility of the housing and stock markets, they sense that there is something amiss; that systems have not responded to their expectations. But the systems have become institutionalized to a degree that has never existed in America before. Previously, because Americans lived in a laissez faire world, only the courts, the local governments and a few federal systems such as the post office were institutionalized rigidly. Now, much of American life, not only in the public sector in areas like Social Security have become rigidly institutionalized and unable to change, but also in the private sector. Firms are no longer permitted to fail.

Labels:

American history,

change,

elitism in America,

ideology,

progressivism,

technology

Subscribe to:

Posts (Atom)