Last Monday Lou Dobbs cited my "Homogeneous" paper, published in the journal Academic Questions of the National Association of Scholars. The whole episode is worth watching, but the reference to my paper is at 18:30.

Friday, April 26, 2019

Thursday, April 25, 2019

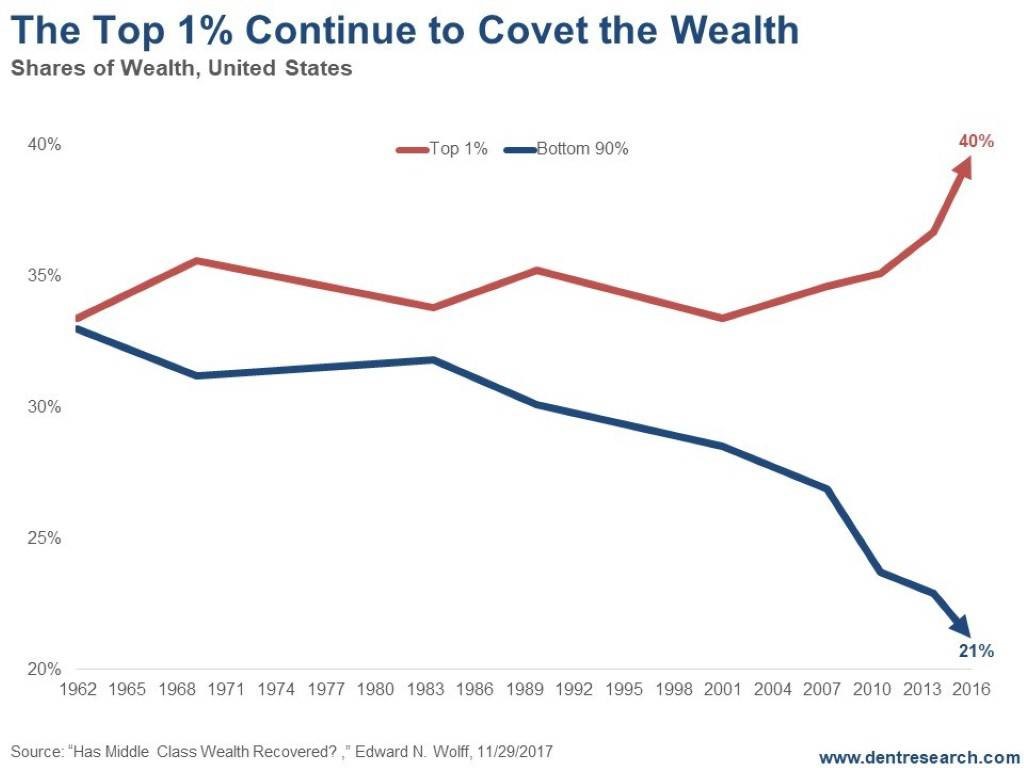

The Greatest Increase in Wealth Inequality in American History Occurred During the Obama Administration

|

| Source: David Stockman Email |

I just received an email from David Stockman's newsletter, and it included the upper graph taken from Edward N. Wolff's "Has Middle Class Wealth Recovered." There are a number of ways to look at the question of rich versus poor; the above graph uses one, the relative shares of the top one percent and the bottom ninety percent. (Disclaimer: I'm one of the nine percent in neither category.)

The gap narrows in the 1970s, but observe the lower graph, which is of real wage growth. Real wages stopped growing in 1973. The reason the wealth inequality declines during the 1970s in the upper graph is that the stock market was falling in the 1970s. Hence, the decline in wealth inequality during the 1970s is a measure of joint pain and only of theoretical importance. The solution put forward by Richard M. Nixon in 1971 was pumping money into the economy via the Federal Reserve Bank.

The gap narrows in the 1970s, but observe the lower graph, which is of real wage growth. Real wages stopped growing in 1973. The reason the wealth inequality declines during the 1970s in the upper graph is that the stock market was falling in the 1970s. Hence, the decline in wealth inequality during the 1970s is a measure of joint pain and only of theoretical importance. The solution put forward by Richard M. Nixon in 1971 was pumping money into the economy via the Federal Reserve Bank.

The pure paper money system established in 1971 helped the wealthy but not the majority. Notice also that the third-most-rapid increase in wealth inequality, according to the upper graph, occurred during the Reagan administration. It began to solidify during the Bush I years, 1988-1992; it remained constant during the Clinton years; then, following the tech bubble bust of 2001 it escalated during the Bush II years, which were the years of the second-greatest gains in wealth inequality. However, Bush and Reagan were pikers compared to Obama, who oversaw the most massive wealth transfers, which followed the 2008 crisis via the expansion of the Federal Reserve's balance sheet, the creation of massive amounts of reserve IOUs called Federal Reserve bank credit, quantitative easing, and so on.

The lower graph tells a slightly different story. Since the early 1970s, when the Fed was given a free hand to redistribute wealth via the creation of paper money, real wages have stagnated. The GDP has continued to grow, although the meaning of GDP is questionable because it includes government spending and make-work projects that do not create value. There is little difference between Democrats and Republicans.

Labels:

bush,

david stockman,

Fed,

income inequality,

money supply,

nixon,

obama,

paper money,

reagan,

wealth inequality

Wednesday, April 24, 2019

King Bear versus Bullzilla

I subscribe to two newsletters with opposite predictions about the markets: David Stockman's Stockman Letter and Steve Sjuggerud's True Wealth, published by Stansberry Research. Stockman is predicting declines in a wide range of markets, including tech and energy, while Sjuggerud is predicting bull markets across the board, but especially in tech and China. There will be a "melt up" (Sjuggerud's term) until a correction, which will occur perhaps 18 months from now.

The great investor Howard Marks, in his book The Most Important Thing, says that being right at the wrong time is the same as being wrong, and from a purely financial perspective he is right. While I'm quoting aphorisms, one that is worth considering is "the trend is your friend."

Sjuggerud doesn't appear to dispute Stockman's underlying theory: The Fed and the current monetary regime are a long-term drain on productivity and economic well being, and the bubble economy it has created is little different from other failed bubble economies of the past, such as John Law's Mississippi Bubble in France in the early 18th century. The ending of a long-term bubble of this kind will not be positive. It may mean long-term stagnation and declining job opportunities, as occurred in Japan, and it may mean a massive crash.

If the trend is our friend, I'm thinking that Sjuggerud's hypothesis is right in the short-run while Stockman's is right in the long-run. Tech and similar investments will do well until they don't. The trick is to gain at least something from the short-term bubbles and to get out while the going is good.

The last tech bubble saw the Nasdaq rise to unprecedented heights. According to Wikipedia: "It reached a price-earnings ratio of 200, dwarfing the peak price-earnings ratio of 80 for the Japanese Nikkei 225 during the Japanese asset price bubble of 1991." It's impossible to know just when a bubble will burst, but it seems to me that the current Nasdaq price-earnings ratio of 18.6 allows leeway for a bubble to proceed. It is true that the prices of today's glamour stocks are at nosebleed levels, but the general market has a ways to go.

The great investor Howard Marks, in his book The Most Important Thing, says that being right at the wrong time is the same as being wrong, and from a purely financial perspective he is right. While I'm quoting aphorisms, one that is worth considering is "the trend is your friend."

Sjuggerud doesn't appear to dispute Stockman's underlying theory: The Fed and the current monetary regime are a long-term drain on productivity and economic well being, and the bubble economy it has created is little different from other failed bubble economies of the past, such as John Law's Mississippi Bubble in France in the early 18th century. The ending of a long-term bubble of this kind will not be positive. It may mean long-term stagnation and declining job opportunities, as occurred in Japan, and it may mean a massive crash.

If the trend is our friend, I'm thinking that Sjuggerud's hypothesis is right in the short-run while Stockman's is right in the long-run. Tech and similar investments will do well until they don't. The trick is to gain at least something from the short-term bubbles and to get out while the going is good.

The last tech bubble saw the Nasdaq rise to unprecedented heights. According to Wikipedia: "It reached a price-earnings ratio of 200, dwarfing the peak price-earnings ratio of 80 for the Japanese Nikkei 225 during the Japanese asset price bubble of 1991." It's impossible to know just when a bubble will burst, but it seems to me that the current Nasdaq price-earnings ratio of 18.6 allows leeway for a bubble to proceed. It is true that the prices of today's glamour stocks are at nosebleed levels, but the general market has a ways to go.

The Woodstock Mystery in Atlas Shrugged

|

| Frank O'Connor Painting |

On page 510 of Atlas Shrugged (of the paperback Signet edition), Dagney Taggart decides to withdraw to a family lodge in Woodstock, which Rand describes as being in the Berkshires. I checked Google Maps and could not find a Woodstock, Massachusetts, although there is a Woodstock, Connecticut and a Woodstock, Vermont.

Rand's husband, Frank O'Connor, was an artist and a member of the Art Students League from 1955 to 1966. The Art Students League opened the Woodstock, New York School of Art in 1906 and discontinued its Woodstock summer program in 1979. According to the Woodstock School of Art's website, a local not-for-profit corporation, the Woodstock School of Art, had taken over the building complex in 1968. I recall when the Art Students League was housed in the Woodstock School of Art building back around 1970. Ironically, the building was built by one of the New Deal's make-work programs, the National Youth Administration. It is currently listed in the national and New York registers of historic places.

My guess is that Rand knew about Woodstock, New York from her husband's involvement with the Art Students League. I'm unclear as to why she decided to say that Woodstock was in the Berkshires. Often, New Yorkers bunch together provincial locales. Alternatively, she may not have wanted to give credit to one of the birthplaces of American communism.*

*From Wikipedia:

The Communist International, to which the UCPA and the CPA both pledged their allegiance, sought to end duplication, competition and hostility between the two communist parties and insisted on a merger into a single organization. That was eventually effected in May 1921 at a secret gathering held at the Overlook Mountain House hotel, near Woodstock, New York. The resulting unified group was also known as the Communist Party of America, which morphed into the Workers Party of America (December 1921) and changed its name in 1925 to Workers (Communist) Party and to Communist Party USA in 1929.

Subscribe to:

Comments (Atom)